School of Accounting

The School of Accounting is dedicated to developing the next generation of forward-thinking accounting professionals. Through a rigorous, hands-on curriculum, students build expertise in financial reporting, auditing, taxation, and managerial accounting.

Taught by experienced faculty, the program emphasizes critical thinking, data-driven decision-making, and practical application in real-world settings. With strong industry connections and a focus on professional development, graduates are equipped for success in public accounting, corporate finance, and beyond.

New Podcast from the School of Accounting

Join us for an interview series in video and podcast formats that focuses on the role of accounting in our communities. Stories range from healthcare to breweries. Cyber risk to government budgets. Banking to entrepreneurs. Prepare to be amazed to learn how accountants save the world! Listen.

School of Accounting Faculty

Respected as some of the best in their field, Eccles School faculty are skilled teachers, innovative researchers and global thought leaders who are shaping the strategic pioneers of the future and transforming business practices worldwide. View faculty.

Upcoming Events

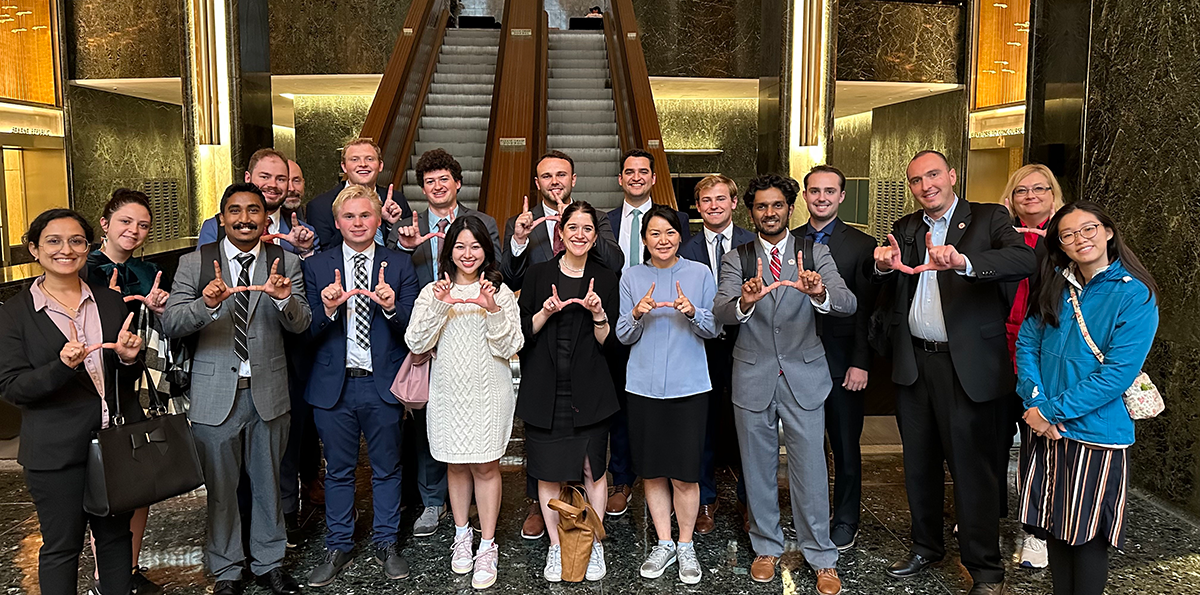

From research seminars, to career fairs, advisory board events, to student trips, the School of Accounting always has plenty of events going on. Find events.